HOW IT WORKS

THE TECHNOLOGY

BuildPay’s technology was designed with years of construction expertise so that all building projects – from new resididential to catastrophe reconstruction – could benefit from being in the chain. Jump to benefits.

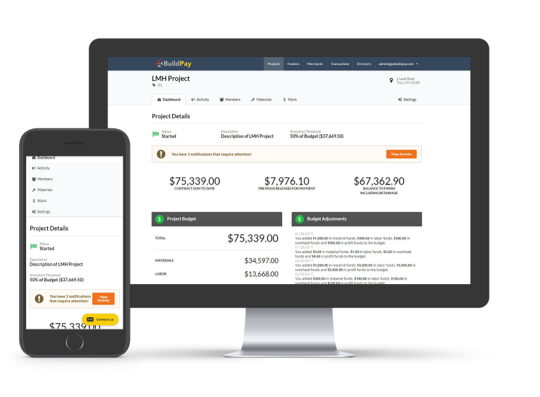

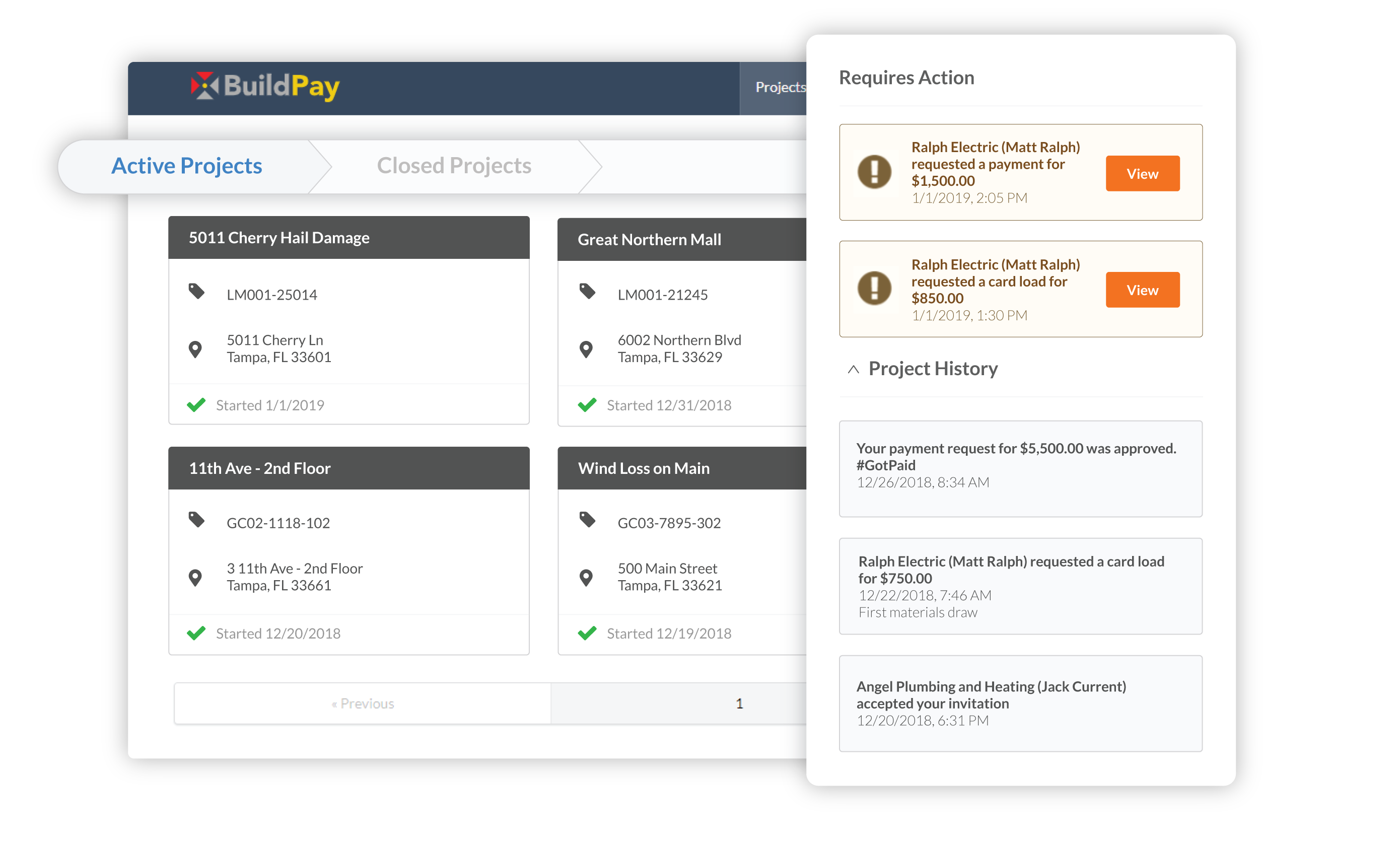

VISIBILITY

The BuildPay dashboard is a reflection of actual dollars on the project, increasing confidence and reducing risk at every level of the construction supply chain.

NETWORK

BuildPay’s dynamic network focuses geographically to incentivize true (and too good to be true) market prices on construction oversight, work, and materials.

POWERFUL PAYMENTS

The patent-pending technology is backed by the strength and security of Chase, which means payments move directly from funders’ banks to providers’ banks.

TRANSPARENCY

The web-based, mobile-optimized interface serves as a hub for adjusters, mortgagees, homeowners, contractors, and material providers (to name a few) to watch their project unfold, make immutable agreements, and leverage data.

BENEFITS

ACCELERATED BUILDS

Reconstruction resources gravitate to projects where payment is faster and more assured.

MARKET PRICING

Assured, fast and transparent cash-flow attract competition for work and direct access to material market prices.

ZERO TRANSACTION FEES

Providers of oversight, work, and materials are never charged a fee, which assures maximum participation.

ELIMINATE RISK

Hardwiring cash-flow on BuildPay projects means no stakeholder can access any other stakeholder’s funds.

TESTIMONIALS

“I could see my contract funds held securely in place, and committed just for our company. Without BuildPay, I can’t see that.”

Brian Sujevich – Green Coast Homes, Inc – Southwest Florida

“Why wouldn’t someone want to protect their funds? They can see exactly where every penny goes!”

Libby Murphy – Gatlinburg ACE Hardware – Gatlinburg, TN

“I’m reluctant to put $200k of material on my account and then have to wait to get paid, which limits the amount of credit we can use for other projects. BuildPay eliminates that concern.”

Jim Baumhardt – President Baumhardt Sand & Gravel, Inc. – Eden, WI

FLORIDA TEST

- 5-6 participating insurers

- Strategic partnerships to leverage data and advantages

- Shared case study findings

- Utilizing BuildPay’s XChange 1.0

- Email [email protected] to find out how to get involved

All construction has one thing in common: it’s all supposed to get paid for. BuildPay is the only company that’s connected at every stage of the project lifecycle and is leveraging advantages from the promises that we make sure are kept.

105 Jordan Road

Troy, NY 12180

© 2019 BuildPay, LLC – All rights reserved.